Overview: The CIMA Certificate in Business Accounting

The CIMA Certificate in Business Accounting serves two main purposes:

- As an entry level route to the CIMA Professional Qualification

- As a stand-alone qualification, giving you a recognised certificate in the fundamentals of accounting, economics, ethics, corporate governance and law.

The qualification has been revised and updated in 2017 following feedback from employers, educators and other key stakeholders. Therefore some new topics have been introduced to the CIMA Certificate in Business Accounting compared to the previous syllabus.

The CIMA 2017 syllabus content and weightings in each paper reflect the emerging issues that business and financial communities are increasingly facing.

They also include a greater emphasis on:

- Professionalism

- Information & decision making

- An introduction to integrated reporting

- The need for increased ethical awareness and corporate governance

You can find the full 2017 CIMA Certificate in Business Accounting syllabus by clicking here

New Exam Structure

The CIMA Certificate in Business Accounting involves passing four CIMA computer based exams which are each two hours long and contain compulsory objective test questions. Short scenarios may be given to which one or more questions will relate.

The objective test questions come in the following different styles:

- multiple-choice

- multiple-response

- number entry

- hotspot

- drag and drop

Want to take a closer look at the different question styles? Then click here

The CIMA Certificate exams can be taken On-demand (year round) at Pearson VUE test centres. And so there are no specific CIMA Certificate exam dates.

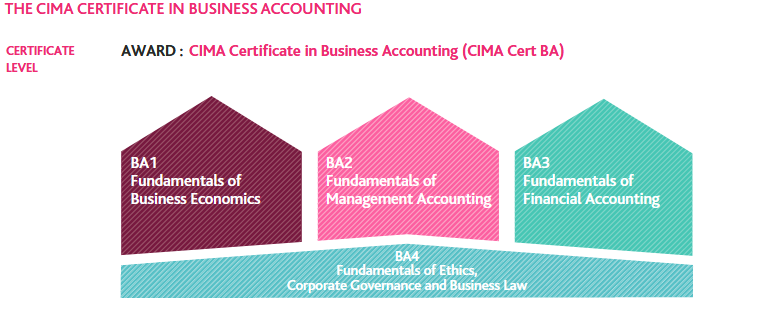

The new CIMA Certificate modules to study for (and pass) are:

- BA1 Fundamentals of Business Economics

- BA2 Fundamentals of Management Accounting

- BA3 Fundamentals of Financial Accounting

- BA4 Fundamentals of Ethics, Corporate Governance and Business Law

The exams will test your ability to demonstrate knowledge, skill and understanding of topics with a focus on practical application relevant to employers and businesses today.

You can therefore expect to be tested on knowledge, comprehension and application.

The results of your CIMA Certificate exams will be available shortly after you’ve finished.

You will be given a provisional pass or fail grade when leaving the Pearson VUE test center. Your final grade (pass, marginal fail or fail) will be published to your MY CIMA account within 48 hours of sitting the exam. This will include specific feedback on your performance against each syllabus section.

You will receive a scaled score which will be in the range 0 to 150; and the CIMA Certificate pass mark that you will need to score is 100 or above.

If you’ve not passed, this feedback will help to guide you in where you need to focus your revision before you attempt to re-sit the exam.

Progression Through the CIMA Certificate Level Qualification

The four exams can be taken in any order and in any combination (so you can study for more than one at the same time if you wish – although I advise to focus on one exam only before moving onto the next )

You will receive a permanent credit for any subject you pass and won’t have to re-sit it again in future.

To move on to the CIMA Professional qualification you must fully complete the CIMA Certificate in Business Accounting before you can sit any of the CIMA Professional exams.

Structure of the CIMA Certificate Modules

Each of the CIMA Certificate Level papers is divided into four broad syllabus topic areas, and a percentage weighting is shown against each topic. Let’s take a look at them…

Syllabus Summary: CIMA BA1 Fundamentals of Business Economics

| Syllabus Area | Description | Weighting |

|---|---|---|

| A | Macroeconomic and Institutional Context of Business | 25% |

| B | Microeconomic and Organisational Context of Business | 30% |

| C | Informational Context of Business | 20% |

| D | Financial Context of Business | 25% |

Syllabus Summary: CIMA BA2 Fundamentals of Management Accounting

| Syllabus Area | Description | Weighting |

|---|---|---|

| A | The Context of Management Accounting | 10% |

| B | Costing | 25% |

| C | Planning and Control | 30% |

| D | Decision Making | 35% |

Syllabus Summary: CIMA BA3 Fundamentals of Financial Accounting

| Syllabus Area | Description | Weighting |

|---|---|---|

| A | Accounting Principles, Concepts and Regulations | 10% |

| B | Recording Accounting Transactions | 50% |

| C | Preparation of Accounts for Single Entities | 30% |

| D | Analysis of Financial Statements | 10% |

Syllabus Summary: CIMA BA4 Fundamentals of Ethics, Corporate Governance and Business Law

| Syllabus Area | Description | Weighting |

|---|---|---|

| A | Business Ethics and Ethical Conflict | 30% |

| B | Corporate Governance, Controls and Corporate Social Responsibility | 45% |

| C | General Principles of the Legal System, Contract and Employment Law | 15% |

| D | Company Administration | 10% |

NB The percentages show the relative weighting of each syllabus topic, i.e. the higher the percentage, the greater the volume needed to be studied. But it’s important to study all areas because all syllabus topics will be examined.

CIMA Syllabus 2017: Guide To Each Paper

To find out more about each paper, click on the relevant links below:

- BA1 Fundamentals of Business Economics

- BA2 Fundamentals of Management Accounting

- BA3 Fundamentals of Financial Accounting

- BA4 Fundamentals of Ethics, Corporate Governance and Business Law

Designatory letters

After passing all four exams you are awarded with the CIMA Certificate in Business Accounting and can use the letters “CIMA Cert BA” after your name

How to Study for CIMA Certificate Exams

You have three main options:

- Attend classes at a local college or university

- Enrol on an a CIMA Certificate Distance Learning (Online) Course

- Self Study using CIMA Certificate Level Books

To read my recommended CIMA study method, please Click here

Having studied the whole syallbus for the exam you are about to take, you should then attempt a number of full mock exams. This will help you to practice your exam technique and feel more at ease with what to expect on your exam day. These can be purchased from your tuition provider seperately or will be included in your CIMA Certificate courses.

Note: As the CIMA Certificate Exams are now formed from an exam question bank, there are no CIMA Certificate Past Papers and Answers.

CIMA Certificate in Business Accounting Cost

There are three main costs involved in taking the qualification:

- Initial CIMA registration fee (with a subsequent annual CIMA Memberhsip fee after your first year)

- CIMA exam fees (and/or CIMA exemptions fees)

- CIMA course fees (or cost of study materials)

Want to find out more about the CIMA qualification cost? Then Click here

Recommended Resources: